It’s been 45 years since the US introduced a new regulated payment rail into the payment ecosystem. That last introduction of a payment rail is what we know today as the ACH network.

Instant Payments, otherwise known as Real-time payments, have been adopted around the world with countries like India, Brazil and China seeing widespread adoption. The USA had its first implementation of it with the introduction of the RTP network from The Clearing House in 2018. This month, July 2023, the Federal Reserve is launching its FedNow service with a pilot group .

An instant payment, by definition, is a real-time transfer of funds between accounts and institutions, resulting in immediate funds availability. Payments can be made at any time with 24/7/365 activity. These transfers are credit push only, meaning the account owner must initiate the transaction through their bank to send money from their account. These funds are also irrevocable, just like cash.

Participants

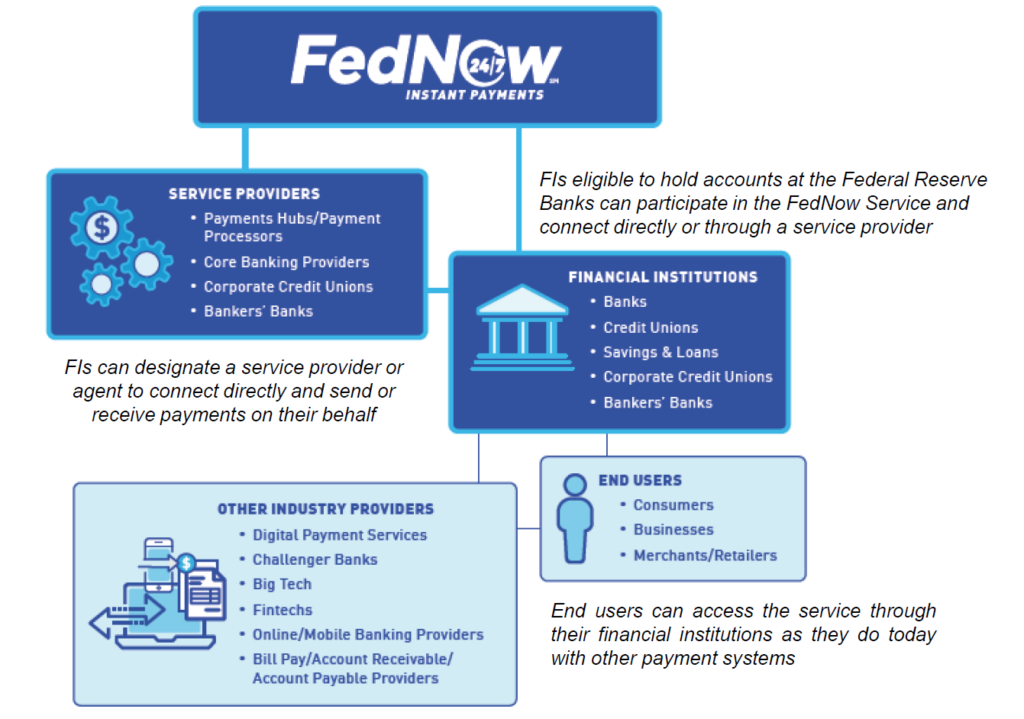

FedNow has published a lot of documentation on how their service will work at launch as well as future deliverables. In this publication, they lay out the participants in this service. This diagram shows the roles of each participant.

FedNow is operated by the Federal Reserve. The entities that will have direct access to this new payment rail are Financial Institutions and Service Providers. These entities are the gatekeepers of the network and are responsible for keeping fraud out of the network.

The Clearing House’s RTP network has a similar structure with direct access to the rails being delivered through Depository Institutions or Third Party Service Providers.

Today, The Clearing House has 300 Participating FIs. According to The Clearing House during a recent Q2 webinar, there are 30 FIs that are send and receive participants. The rest are only receiving participants. This means that only 30 banks are permitting the initiating of RTP credit transactions for their account holders.

According to the FAQ on The Clearing House website, they currently reach 65% of the Deposit Demand Accounts in the USA but the institutions that participate hold 90% of the US DDAs.

Consumers are presented with many services that appear to be instant payments. Services like Zelle, Venmo, CashApp all provide instant availability to the consumer however, these are simply applications running on the different existing payment rails such as ACH, debit card networks, the RTP network and now FedNow. These applications differ from instant payments in that they behave as wallets and the funds are not in FDIC insured accounts. Using FedNow and RTP you will have the security of your FDIC insured account at the bank and will not be exposing your account information to these third parties for funding these wallets.

Use Cases

There are many use cases that are already in existence in the United States due to the RTP network being active for the last 5 years. Typical use cases are refunds/rebates to consumers, payroll adjustments, payroll funding, and bill pay. With the limitation on the number of banks providing send capabilities (10%) bill pay is limited as the consumers are not offered the capability to generate the instant payment today.

Three interesting use cases that have been discussed by The Clearing House and FedNow are:

- Account-to-Account transfers (A2A) Over 40% of US bank account holders have accounts at more than one bank. Today consumers are writing themselves checks, or connecting both accounts to a third party that can move the money between them. These methods have a delay in funds availability using the ACH network. Now, with instant payments, you can move money instantly between your bank accounts at different institutions, provided they are both connected to the same instant payment network.

- Earned Wage Access In today’s market of the gig economy where you can pick up odd jobs through Uber, Lyft, etc. the ability to be able to get paid out immediately is appealing. Another compelling use of instant payments is for paying out tips at the end of a shift. Today, many servers are provided their tips in cash at the end of their shift but the main payment method used at the restaurant is card. This forces the business owner to have cash on hand to pay out the tips each evening. With instant payments, the business owner can push out the tips instantly to the server’s bank account reducing the need for extra cash on hand.

- Business Payments With the instant payment networks, RTP and FedNow being open everyday, there is an uptake in activity on the weekends due to other rails not operating on weekends.

FedNow shared that the U.S. Department of the Treasury’s Bureau of the Fiscal Service will be live on day one of the FedNow service. In theory, the US Treasury will be able to issue you payouts instantly while dealing with you on the phone or through your filings.

Benefits

Although other payment rails, like ACH, still play their important roles in payments, Instant Payments bring a lot of benefits to the marketplace. Here are some of the biggest benefits:

- Ultimate control of your cash flow – with instant payments the time between the money coming out of your account and being received by the entity you are paying is now completed in seconds. Previously, to have an on-time payment you had to send the payment at least 1 to 2 days in advance from your bank account. Now you will be able to send the payment on the day it is due, maximizing the time in your control.

- Irrevocable Payment – accepting instant payments means you know the funds are good and that they are not going to be claimed back through the system. Now, if there is a reason to need the funds back, the consumer will need to work with the merchant directly and the merchant will be able to send the refund in real-time to the consumer while they are on the phone. This is a much better experience than the one we have today where consumers are instructed to wait for the refund to show up in the next 5 days.

- Cost Effective – Instant payments can replace the need for more expensive methods of payment, such as Wire Payments. Also due to the good funds model, there is no cost in dealing with exception items that come back as returns.

- Immediate Settlement – the funds are immediately available in your bank account when you are receiving funds. This push of funds from the payor’s account ensures that a payment is not being made when there are not sufficient funds available. When the funds are sent, they are immediately withdrawn from the payor’s account and immediately credited to the payee’s account.

- Additional data accompanies the transaction which will make it easier to attribute the payment to a particular invoice or customer.

With the addition of FedNow providing instant payment capability in the USA alongside The Clearing House’s RTP network, more banks will provide this capability to their account holders. The consumer acceptance and confidence in the new capabilities will accelerate the use of real-time payments across the nation transforming how we operate. Fintechs are innovating with applications to accommodate this new powerful rail bringing value to in-person and online commerce. Welcome to the future.