I vividly recall a NACHA payments conference from several years ago where the speaker on stage captivated the audience with an animated presentation on the risks associated with using paper checks. The attendees, all proponents of ACH payments and electronic money movement, shared a hearty laugh as they collectively poked fun at the antiquated paper-based payment method. The speaker artfully highlighted the vulnerabilities of checks, emphasizing how this seemingly innocent piece of paper conspicuously displays one’s full name, physical address, and sometimes even a phone number, along with the complete checking account number and Bank ABA routing details. To top it off, one willingly adds their legally binding signature to this document. As if that weren’t enough, they seal it inside an envelope, slap a stamp on it, and trust the United States Postal Service to deliver it safely across the nation.

Our faith in the USPS’s security is generally well-founded. Nevertheless, recent developments have shown that checks are increasingly being pilfered from the mail. These thieves alter the “pay to” line, cash the check, and effortlessly vanish with ill-gotten gains. The check issuer observes the transaction as it clears their account, often oblivious to any wrongdoing. The assumption is that the check has reached its intended recipient, and the account is duly settled. But what if it wasn’t paid, and you find the IRS knocking at your door? In such a situation, you delve into your bank account, pull up the check image, only to discover that the “pay to” line has been maliciously altered without your knowledge. Had that check been converted to an ACH payment, you wouldn’t even have an image to cross-reference. The unsettling part is that these perpetrators now possess all the essential information required to forge their own checks or create ACH payments bearing your personal details.

Regrettably, this isn’t a hypothetical scenario. Anyone perusing the NextDoor app will encounter countless stories mirroring these incidents. If you’re not familiar with NextDoor or haven’t come across this phenomenon, here’s a recent screenshot of a similar occurrence.

Given the substantial personal information contained in checks and their susceptibility to manipulation, one might wonder when the United States will finally abandon this outdated payment method. Yet, if we consider history as a guide to the future, the answer appears to be “never.”

Nonetheless, there is hope. Advancements in check processing, such as Remote Deposit Capture, have fortified the security of check payments. Moreover, the utilization of checks is on the decline as new payment technologies emerge, and subsequent generations increasingly eschew paper payments.

Federal Reserve studies confirm the declining use of checks in the United States. This decrease can be attributed to both the convenience of electronic payment methods and the generational shift in payment preferences. According to data from the Javelin Strategy & Research’s report, “How Pay-by-Bank Could Shake Up Payments,” the following payment preferences by generation have been observed:

- 31% of the Silent Generation prefer to pay by check.

- 23% of Baby Boomers favor check payments.

- 15% of Gen X’ers lean towards checks.

- A mere 8% of Millennials show a preference for paying by check.

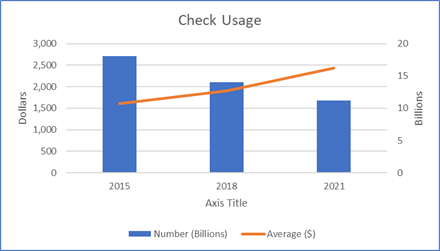

Statistics on check usage since 2015 reveal a decrease in the number of checks being used, while the average value of checks has increased. This trend aligns with the observation that smaller payments are transitioning to online payment methods, driven by peer-to-peer platforms like Zelle, CashApp, and Venmo. The Federal Reserve Payments Study in 2022 supports this shift:

- The average value of check payments rose significantly from 2018 to 2021, increasing from $1,908 in 2018 to $2,430 in 2021. This increase occurred despite a substantial decrease in the number of check payments.

- The number of checks issued has been declining at a rate of 7.2% per year since 2018, reaching 11.2 billion in 2021. Nonetheless, the value of check payments stood at a substantial $27.23 trillion in 2021, constituting around 21% of non-cash payments by value.

This chart illustrates the declining number of checks alongside an increase in their average value. With billions of checks still being issued, it is evident that we have a long way to go before checks are phased out entirely.

With the introduction of FEDNow and the Clearing House’s RTP networks, it is anticipated that the rate of decline in check usage will accelerate. This mirrors the experiences of other countries that have embraced digital payments, and further insights can be found in the Atlanta Fed’s report comparing the USA’s check usage with that of other nations. This idea of instant payments supplanting checks was also discussed at Payments 2023, particularly when analyzing payment volumes in Sweden following the launch of their Instant Payment network in 2012.

In conclusion, it’s clear that while checks have been a staple of financial transactions for generations, their continued existence in the modern payment landscape faces significant challenges. The vulnerabilities associated with checks, such as their susceptibility to theft, alteration, and the exposure of sensitive personal information, raise concerns about their long-term viability.

Nevertheless, as we’ve explored, the evolution of payment technologies and shifting generational preferences are gradually reshaping the way we conduct financial transactions. With advancements in secure check processing methods, as well as the emergence of convenient digital payment platforms, it’s becoming increasingly evident that checks are no longer the primary choice for many.

The statistics reveal a decline in the number of checks being used, but an increase in their average value, a trend reflective of the changing payment landscape. Despite this, it’s essential to acknowledge that checks still hold a significant place in our financial system, with billions of them in circulation, and they continue to serve certain purposes effectively.

Looking forward, the implementation of real-time payment networks such as FEDNow and the Clearing House’s RTP system signals an accelerating shift away from traditional checks. We can draw insights from other nations that have embraced digital payments, underscoring the potential for this transformation to reduce our reliance on checks. As we’ve seen, the journey toward a check-free financial world is well underway.

In this evolving financial landscape, we have learned that checks are far from obsolete, but their role is changing. Understanding these shifts in payment preferences and technology is essential for staying ahead in the financial sector. It is our hope that this exploration has provided you with valuable insights into the enduring presence of checks, their ongoing relevance, and the forces reshaping the future of financial transactions. As the financial world continues to transform, staying informed and adaptable is key, ensuring that you can navigate these changes with confidence and efficiency.